The transportation industry plays a crucial role in driving economic growth and facilitating the movement of goods across the United States. As the industry continues to evolve, it’s important to assess its current state, challenges, and factors that influence rate changes and trends in the industry. In this article, we present the findings from a recent survey conducted by PRO Transportation.

This study aims to gain insights into the transportation industry by seeking the opinions and perspectives of industry professionals including shippers and carriers. Through an analysis of the survey responses, we aim to provide an understanding of the industry’s rate stability, prevailing challenges, and the primary factors responsible for recent rate changes. The findings presented holds implications not only for industry stakeholders, but also for policymakers and organizations seeking to enhance their services in this dynamic sector.

In addition to rate stability, the survey also sought to identify the primary challenges faced by industry professionals. Understanding these challenges is vital to enhancing the efficiency and effectiveness of transportation operations. This study aimed to determine the factors that industry professionals attribute to recent rate changes influenced by factors such as fuel costs, regulatory policies, and market demand.

By examining rate stability, prevailing challenges, and the primary factors influencing recent rate changes, we intend to contribute to the ongoing conversation surrounding industry. Through a comprehensive analysis of the survey responses, we hope to provide recommendations and strategies to address the identified challenges and improve the overall efficiency of the transportation industry.

Shipper’s Responses

Stability in Rates

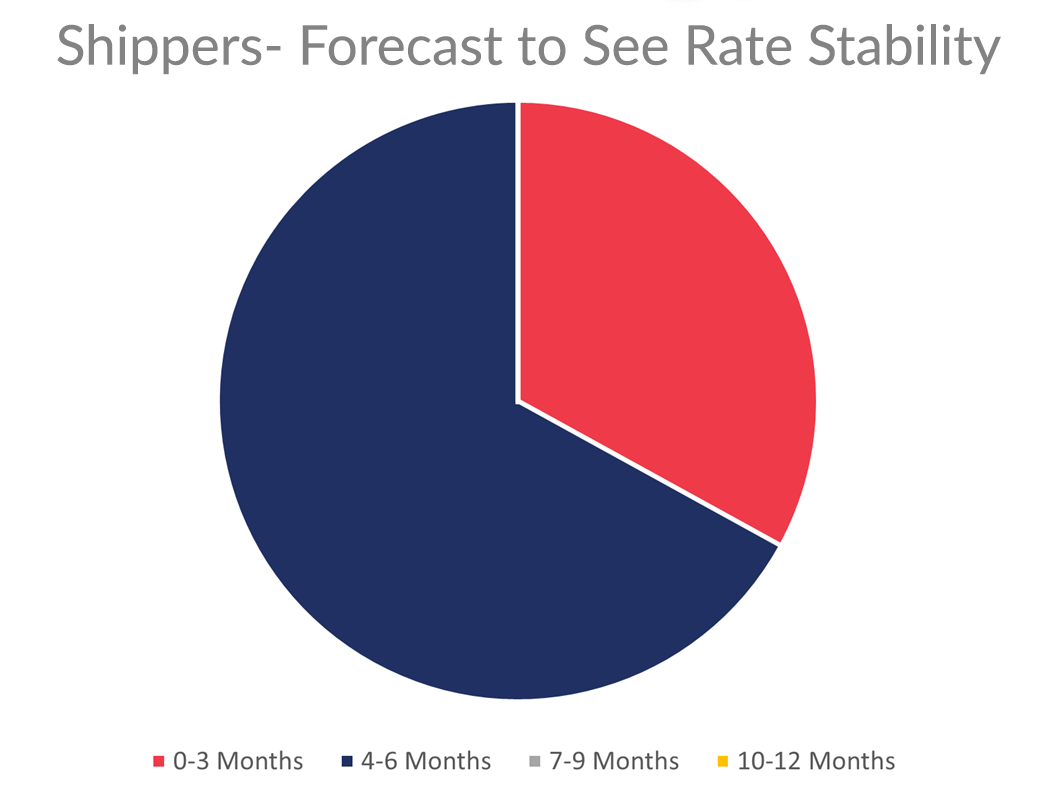

The survey gathered insights from shippers in the trucking industry regarding their forecasts for stability in rates. Analysis of the responses highlighted a cautious outlook among the participants. Only a small portion of respondents (33%) predicted stability within the short term, specifically within 0-3 months. Additionally, 67% of participants envisioned a slightly longer timeframe while anticipating rates to stabilize between 4-6 months. No respondents indicated a forecast of stability within 7-9 months or 10-12 months. These findings suggest that shippers have a relatively optimistic view of achieving rate stability within the next several months, with a majority expecting it to occur within 4-6 months.

The survey gathered insights from shippers in the trucking industry regarding their forecasts for stability in rates. Analysis of the responses highlighted a cautious outlook among the participants. Only a small portion of respondents (33%) predicted stability within the short term, specifically within 0-3 months. Additionally, 67% of participants envisioned a slightly longer timeframe while anticipating rates to stabilize between 4-6 months. No respondents indicated a forecast of stability within 7-9 months or 10-12 months. These findings suggest that shippers have a relatively optimistic view of achieving rate stability within the next several months, with a majority expecting it to occur within 4-6 months.

Shippers Preventive Measures

We intended to understand the measures implemented by shippers in the trucking industry to prevent a recurrence of the rate challenges faced during the COVID-19 pandemic. Analysis of the responses revealed a range of approaches adopted by the participants. A portion of respondents (33%) reported cutting their carrier base as a measure to mitigate rate challenges. In contrast, a larger proportion of participants (67%) mentioned enlarging their carrier base as a strategy to address the issue.

None of the respondents indicated shortening their Request for Proposal (RFP) terms as a measure to prevent rate challenges. Although the survey respondents didn’t indicate a change in their RFP process, PRO has experienced a major shift into shorter RFPs since the market became unstable.

These findings suggest that shippers have taken different approaches to enhance their carrier network to combat potential rate difficulties. While some have opted to reduce their carrier base, others have sought to expand it, indicating a divergence in strategies. The absence of respondents shortening their RFP terms indicates that this measure may not be widely implemented among shippers to address the rate challenges experienced during the pandemic.

Important Carrier Qualities

PRO anticipated uncovering the qualities that shippers value when selecting carriers. The responses from the participants reflected a range of considerations in their decision-making process. No respondents mentioned cutting live tracking as a quality they look for in carriers. However, an equal number of participants (50%) highlighted service levels and rates as important factors. Additionally, an equal number of respondents (50%) emphasized the significance of having a dedicated service representative.

None of the participants mentioned excess insurance coverage as a key quality that they seek in carriers. These findings indicate that shippers prioritize service levels, rates, and the availability of a dedicated service representative when selecting carriers. The absence of emphasis on live tracking and excess insurance coverage suggests that these qualities may not be as influential in the decision-making process for shippers in the trucking industry.

Carrier’s Responses

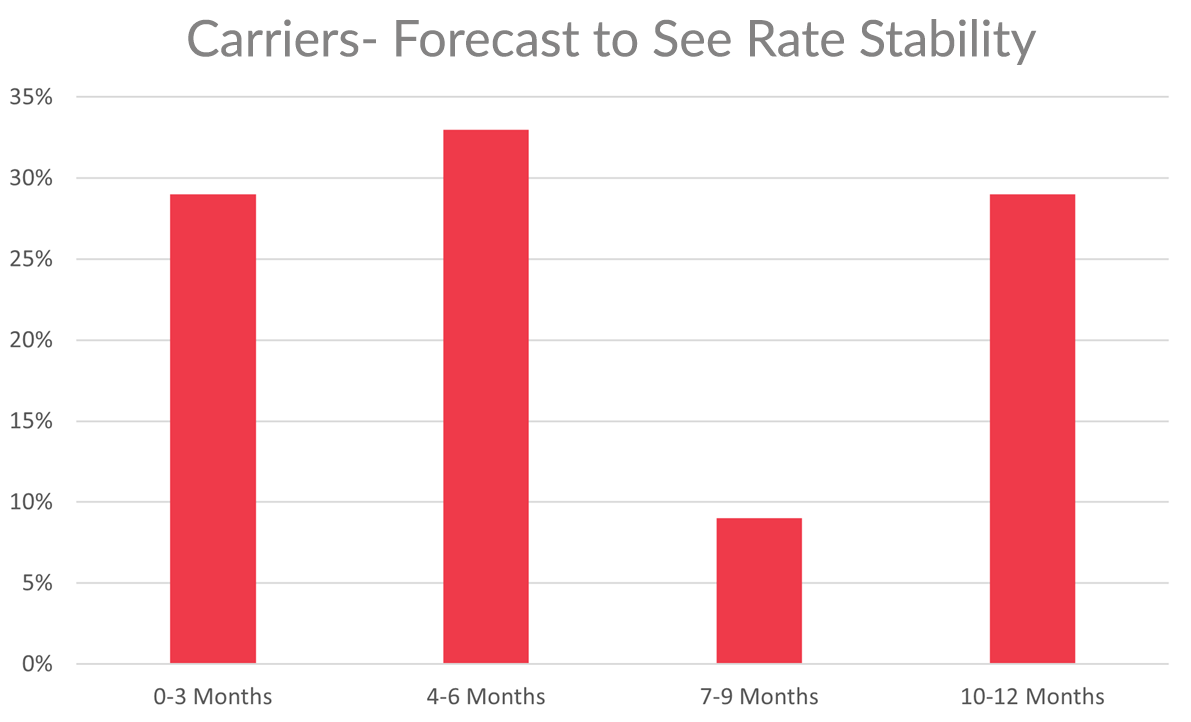

Carriers View Regarding Stability in Rates

This section of the survey aimed to understand carriers’ predictions regarding the timeline for rate stability. Analysis of the responses showed a diverse range of expectations among the participants. Most respondents (33%) envisioned rate stability between 4-6 months. Additionally, 29% believed that stability would be achieved within the short term, specifically within 0-3 months. Another 29% of participants expected a longer timeframe, with rates stabilizing within 10-12 months. A smaller number of participants (9%) expected it to occur within 7-9 months.

These findings highlight the varying perspectives on the timeline for rate stability, indicating a significant portion of respondents envisioning it to occur within the first few months, while others anticipate a more gradual process extending up to a year.

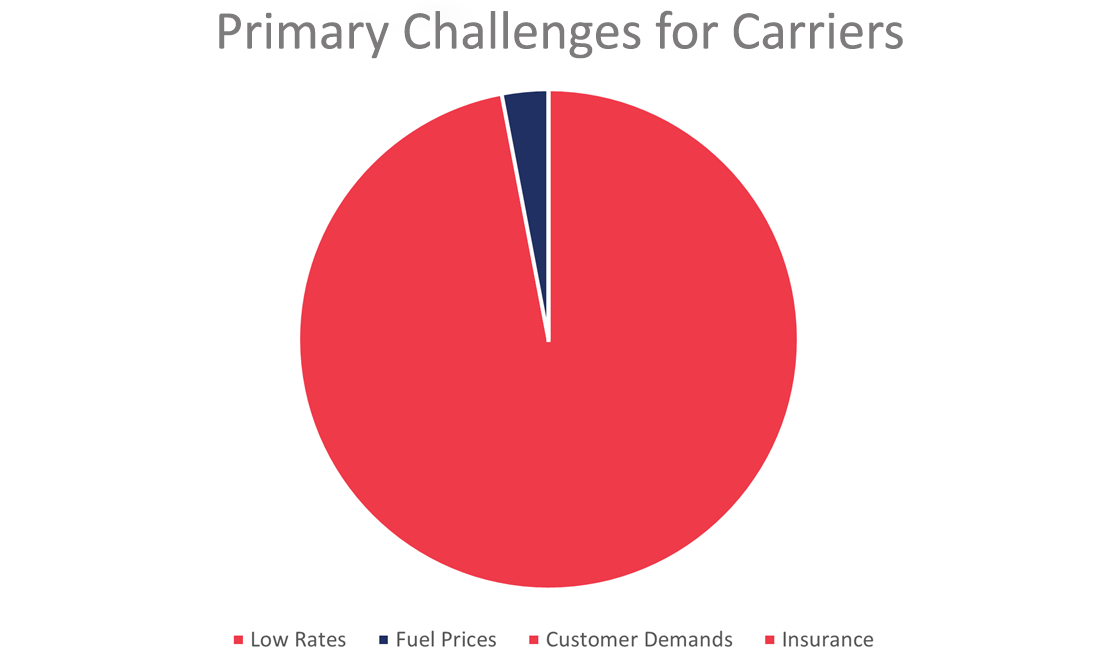

Primary Challenges for Carriers

The responses from the carrier group revealed a clear and dominant concern among the participants. A significant majority (97%) of respondents highlighted low rates as their primary challenge. A small percentage (3%) mentioned fuel prices as their primary concern, indicating a relatively minor challenge in comparison to low rates.

None of the respondents reported keeping up with customer demands or insurance/maintenance as their primary challenges. These findings underscore the overwhelming impact of low rates on carriers, signifying a critical issue that demands attention within the trucking industry. The limited mention of other challenges suggests that, at present, low rates pose the most significant obstacle for carriers, overshadowing other potential concerns.

Responsibility for Adjustment in Rates

The responses from the drivers showcased diverse opinions on this matter. Among the respondents, 46% believed that brokers held the primary responsibility for these adjustments. In contrast, a smaller proportion of participants (10%) attributed the responsibility to shippers. Furthermore, 40% of respondents identified supply and demand as the main driver behind these rate changes.

These findings highlight the varying viewpoints among carriers regarding the key stakeholders influencing rate adjustments. While a significant portion of carriers perceive brokers as primarily responsible, others attribute the changes to the dynamics of supply and demand in the industry. These perspectives indicate the complex interplay of different factors shaping rate fluctuations in the trucking industry.

Carrier Input

Carriers expressed their concerns about the challenges they face in the transportation industry, particularly due to high fuel prices and low rates. The combination of these factors makes it increasingly difficult for smaller carrier companies to sustain themselves.

The rates being offered are described as severe, with some brokers losing bids to cut-rate companies, leading to concerns that many businesses may shut down within the next six months. The impact is not limited to smaller companies, as larger companies may also struggle with payroll and equipment maintenance. Carriers emphasized the need for collaboration between shippers, carriers, and brokers to establish more stable and reasonable rates.

In response to the unfavorable conditions, carriers have resorted to rejecting loads that are below their cost to avoid financial losses. Understanding costs was highlighted as crucial for carriers and brokers alike.

Conclusion

The survey conducted regarding the trucking industry shed light on the perspectives and challenges faced by shippers and carriers. Shippers expressed cautious optimism regarding rate stability, with a majority expecting it to occur within the next 4-6 months. They employed various measures to prevent rate challenges, such as adjusting their carrier base. When selecting carriers, shippers valued service levels, rates, and dedicated service representatives. Carriers, on the other hand, voiced concerns about low rates and the financial strain it imposes on their businesses. They called for collaboration and a better understanding of costs within the industry.

These findings underscore the importance of addressing rate stability and the need for effective communication and cooperation among all stakeholders in the trucking industry. By understanding the perspectives and challenges of both shippers and carriers, industry players can work towards creating a more sustainable and mutually beneficial transportation landscape.